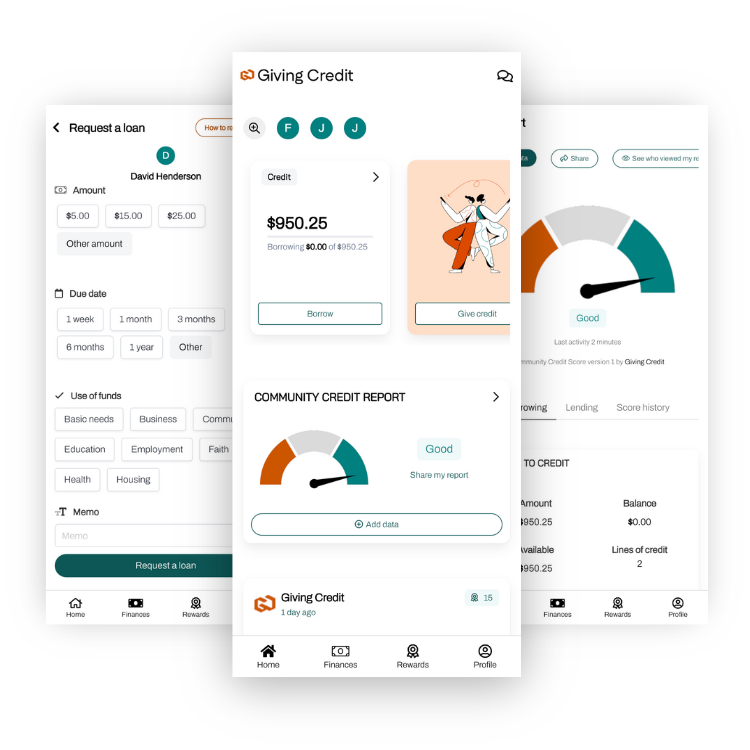

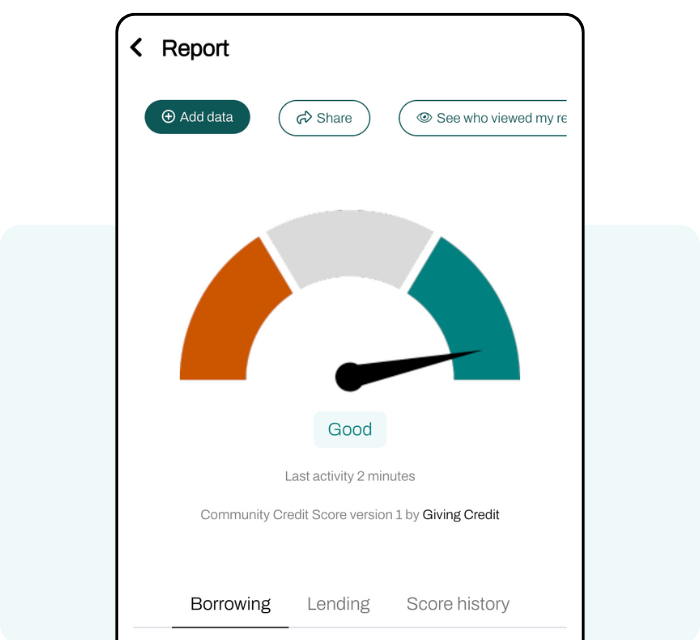

Giving Credit is the community finance credit reporting agency.

Our mobile app facilitates and rewards peer lending in financially excluded communities, collects and aggregates community finance data, and partners with financial institutions to use community finance data for underwriting mainstream credit products.